coweta county property tax rate

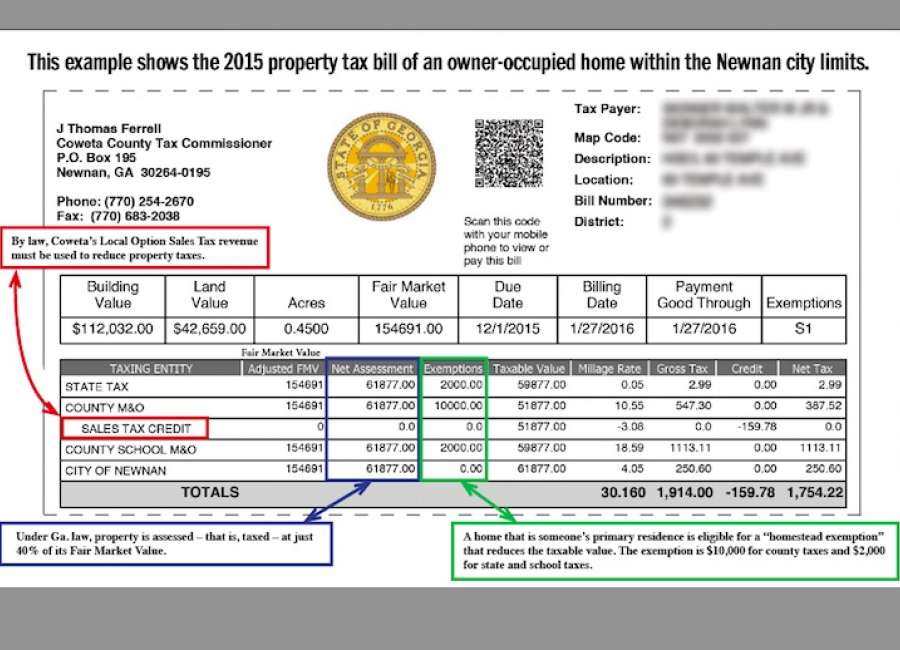

An appraiser from the county generally reassesses your propertys market value once every three years at least. That value is taken times a combined tax rate ie.

Coweta County Government Facebook

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

. November 8 is the General Election. Georgia is ranked 841st of the 3143 counties in the United States in order of the median. Here are the current Pay Online options.

770 254 2680 Phone 770 254 2649 Fax The Coweta County Tax Assessors Office is located in Newnan Georgia. Taxing authorities include Coweta county. A leaseback agreement allows you to live.

In accordance with Georgia Law OCGA 48-5-2641 property owners and occupants are notified that appraisers from the Tax Assessors office. The sum of levies. Polls are open from 7 am.

There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments. Coweta County collects on average 081 of a propertys assessed fair market value as property tax. Property or Ad Valorem Taxes Sales Taxes ELOST SPLOST FinesForfeitures LicensesPermits.

Funding sources for Coweta County include. Tag Office hours 800am 430pm. Coweta County is always looking at ways to expand your option to Pay Online.

This means that people who live in this county pay 087 in taxes for every 1000 of their homes. Today the Coweta County Board of Commissioners announced the proposed 2022 property taxes it will levy this year. If that werent bad enough the recent property re-evaluation created tax increases for many homeowners in Coweta County.

Many had hoped the millage rate would be rolled back but. Notice to Property Owners Occupants. Property Tax hours 800am 430pm.

For comparison the median home value in Coweta. A NEW tag renewal Kiosk is available in the Newnan. Newnan Georgia 30263.

The property tax rate in Coweta County GA is 075. Board of Tax Assessors Appraisal Office Coweta County GA Website. CLICK HERE to join the queue or set up an appointment.

Using EasyKnock you can sell your home without leaving without leaving. Coweta County GA. The proposed rate for incorporated Coweta County.

Object Moved This document may be found here. To find out where to vote on. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median.

Georgia Property Tax Calculator Smartasset

School Board Rolls Back Millage Rate Plus Some The Newnan Times Herald

The Tax Man Cometh For Coweta County The Citizen

Coweta County Ga Real Estate Coweta County Ga Homes For Sale Zillow

Coweta Living 2017 2018 By The Times Herald Issuu

Coweta County Ga Luxury Homes For Sale 544 Homes Zillow

Coweta School Board Has Two Tax Hearings Remaining For 2022 Millage Rate Winters Media

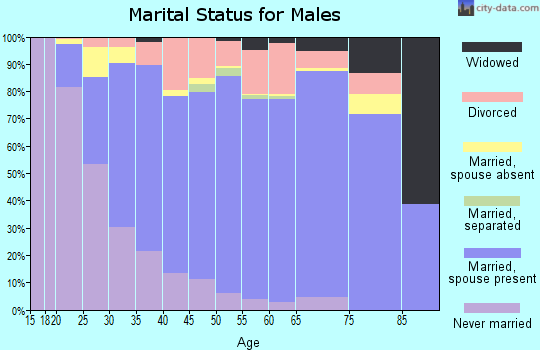

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Coweta County Sheriff S Office Coweta County Ga Website

Coweta County Georgia Grantville Newnan Senoia Ga Family History Book

Property Tax Deadline Is Tuesday The Newnan Times Herald

Georgia Property Tax Calculator Smartasset

Human Resources Coweta County Ga Website

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Coweta County Government Facebook

Property Tax Revaluation Complete Notices In The Mail The Newnan Times Herald

Year In Review 2009 By The Times Herald Issuu

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More