salt tax impact new york

Salt Tax New York. 52 rows States with high income taxes account for most SALT deductions.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Search only database of 8 mil and more summaries.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. As a result of this legislation the SALT deduction has been reduced. Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes paid. The bill passed on Thursday includes some budgetary gymnastics in order to avoid.

Now as New York State reckons with the vast economic impact of COVID-19 including a workforce depletion of more than one million jobs eliminating the SALT limitation is imperative. More recently in 2021 it was brought up again to increase the 10000 limit. And it would cost the Treasury at least 80 billion a year at a time when the federal government is already pouring out trillions in new spending.

We are seeking a SALT professional with 6-10 years of state and local tax experience to join our team. At least six states have issued guidance on withholding on wages paid to teleworking employees including Maryland Massachusetts Mississippi New Jersey Ohio and Pennsylvania. New York made up the next highest percentage of national SALT deductions at 13 of all deductions.

For example in 2017 the average SALT deduction in New York was 23804 compared to just 5451 on average in Alaska. After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000. The sales tax deduction provides similar incentives for encouraging spending which facilitates economic growth.

The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial. The Tax Cuts and Jobs Act of 2017 TCJA imposed a 10000 cap on the itemized deduction for state and local taxes SALT from 2018 through 2025. New York is already the nations leader.

Collected from the entire web and summarized to include only the most important parts of it. Only 21 used the salt deduction for. In all some 83 percent of.

Standing Together On Severance Tax Essential Economics Essentials Chamber Of Commerce For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy. Compared with other common deductions the state and local tax deduction had a larger impact than the deductions for both charitable giving and mortgage interest. In New York the deduction was worth 94 percent of AGI while the average across.

It would also raise the cap for the salt deduction from 10000 to 80000 per year. Can be used as content for research and analysis. I and many of my colleagues from New York stand prepared to work with House Leadership to restore the SALT deduction.

New York also will allow. 11 rows The average size of those New York SALT deductions was 2103802. Since the SALT cap was put into place however very high earners have seen a sharp reduction in the deduction as a percent of AGI from 77 percent in 2016 for those earning over 500000 to 071 percent in 2018.

We are a boutique state and local tax consulting firm and our consultants come from a variety of backgrounds including law firms Big 4 accounting firms industry and governmental agencies. Going forward leaving untouched the rest of the TCJA changes restoration of the SALT deduction would mainly benefit high-income residents of New York and a handful of other high-tax states. One obvious point of.

The SALT deduction allows states and localities to shield certain taxpayers from the full force of the tax increases essentially encouraging state and local governments to increase taxes. The value dropped so. The states tax code and estimated the fiscal impact of SALT on New York taxpayers.

The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. Salary 150000 - 220000 per year. Salt tax impact new york.

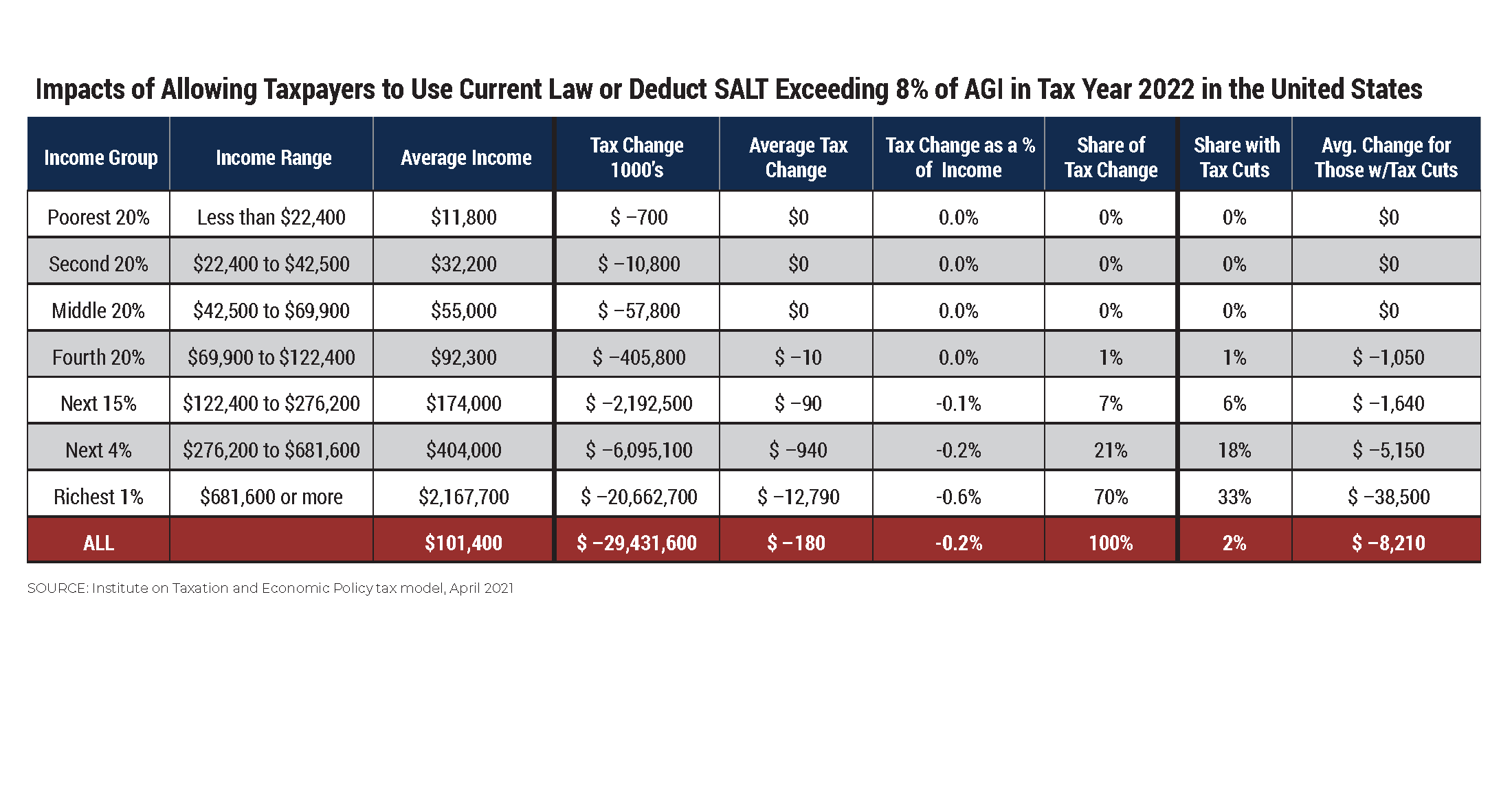

New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. It is useful to compare the distributional impact of SALT cap repeal to other tax policies or packages. In recent years 295 of tax units used the SALT deduction.

In particular California filers accounted for 21 of national SALT deductions in 2017 based on the total value of their SALT deductions. Salt tax impact new york Saturday February 19 2022 Edit. The department estimated that in one year New York State households would pay an additional 123 billion in personal income taxes and the SALT cap could cost taxpayers.

This consequential tax legislation available to electing pass-through entities provides a. While one could reasonably consider the COVID-19 pandemic to satisfy such an allowance it appears New York tax authorities may think otherwise. The Trump administrations SALT policy is retribution politics plain and simple Cuomo said.

On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021. During initial talks about tax reform the SALT deduction was almost eliminated. Home Blog Pro Plans Scholar Login.

Residents of New York. 53 rows The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments. The SALT cap was tucked into the 2017 tax overhaul in part to help finance it and reduce its impact on the deficit.

Salt Tax New York. Advanced searches left. Pin On Origin Of Lier In recent years 295 of tax units used the salt deduction.

Lifting the SALT cap much more pro-rich than Trumps tax bill.

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Salt Deduction Salt Deduction Taxedu

Luxury Real Estate Is Headed For A Downturn But The Exodus Of Wealthy New Yorkers Could Create A Bigger Impact On The Real Estate Prices Tax Help Tax Attorney

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Letter Written By Mahatma Gandhi At The End Of Salt March At Dandi In Which He Asks The World To Under Stand Hi Lettering Signatures Handwriting Mahatma Gandhi

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

How Does The Deduction For State And Local Taxes Work Tax Policy Center

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Robert Smithson Robert Smithson Archives Of American Art Exhibition Poster

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Feds Raise The Tax Bar Higher For Ny Empire Center For Public Policy